US HOUSING REDITUS FUND

US HOUSING REDITUS FUND

Is a real estate investment company created for the purpose of acquiring, managing, and developing a portfolio of real estate properties in the United States territory.

STRATEGY

Our model focuses on investments in real estate opportunities that generates ATTRACTIVE profits with a MODERATE RISK PROFILE for our investors. Buying, enhancing, renting and holding real estate assets for a determined period of time is our portfolio managers investment strategy.

INVESTMENT FOCUS

INVESTMENT FOCUS

US HOUSING REDITUS Fund will acquire land for multifamily development(new construction), further rental stabilization and sale and will also acquire income producing Multi-Family Properties (existing construction). Once acquired existing construction, additional cash will then be invested to upgrade properties. An extensive repositioning plan will be prepared which calls for the improvement of community amenities, exterior enhancements and appropriate interior unit renovations. The proposed repositioning value-added plan is expected to improve the rents significantly. A higher-quality renter pool will likely be able to sustain greater increases in rent and will also likely take better care of the physical space they are renting.

LAND FOR NEW CONSTRUCTION

US HOUSING REDITUS Fund will purchase land for new construction and will acquire, at discounted price based on current market value, Single Family Homes existing construction strategically located in neighborhoods within US suburban and underdeveloped communities, were there is a current shortage of supply in this type of homes. All properties are fully renovated or new construction, insured, rented and managed by an expert property manager. We are targeting on holding this homes for a period of 3 to 5 years.

PORTFOLIO MANAGERS

- Reditus Group is a joint venture of highly educated professionals with a long-term standard record in financial services. Reditus has a network of individual, institutional clients, and private fund managers to whom it renders portfolio management services. As portfolio co-manager, Reditus will be responsible for coordinating the risk committees of the fund.

- ASV is a General Contractor company offering construction services in terms of Site Analysis, Feasibility Studies, Preliminary Design Studies and Permit/Zoning Applications. As portfolio co-manager, ASV is responsible of assessing the technical feasibility of construction projects.

- US Housing Portfolio Manager LLC. is a real estate investment and development company based in Miami whose core business activities are land banking, development, asset a

VALUE

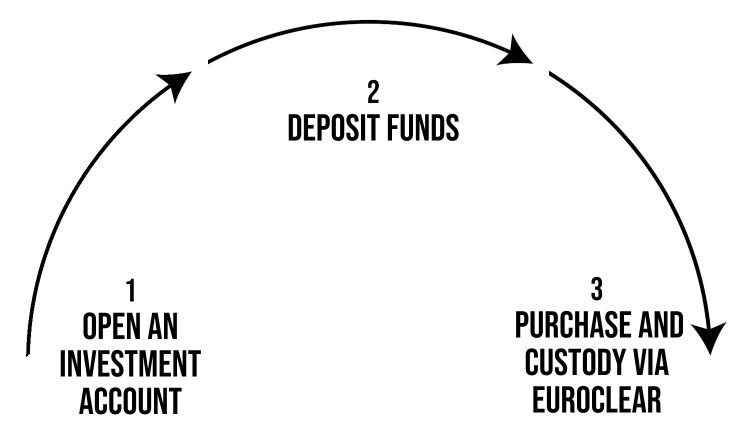

HOW TO INVEST IN US HOUSING?

RECENT PROJECTS

- All

- Buy and Flip

- Investment

- New Construction

Properties Rehab – 3632 NW 30th Ct. Lauderdale Lakes, FL 33313

Properties Rehab – 6336 Southwest 21st Street Miramar, FL 33023

Properties Rehab – 1425 S 24th Ave. Hollywood, FL 33020.

Properties Rehab – 121 Allen Rd. West Park, FL 33023

Properties Rehab – 4130 SW 25th St. West Park, FL 33023

Properties Rehab – 1400 North 67th Ter. Hollywood, FL 33024

Properties Rehab – 142 SW 22 AVE. Fort Lauderdale, FL 33312

Properties Rehab – 7001 Environ Blvd. Lauderhill, FL 33319

Properties Rehab – 132 SW 24 AVE Fort Lauderdale, FL 33312 – SOLD

Properties Rehab – 113 Sw 21 Way Fort Lauderdale, FL 33312

Properties Rehab – 138 SW 24 AVE Fort Lauderdale, FL 33312 – SOLD

UNDER CONSTRUCTION – 2541 NW 9th St. Fort Lauderdale, FL 33311 – 1 Residential Unit

UNDER CONSTRUCTION – Orange Grove Manors at Oakland Park – 19 Residential Units

UNDER CONSTRUCTION – 12116 NE 5th Ave. North Miami, FL 33131 – 12 Residential Units

UNDER CONSTRUCTION – 1047 NE 132 St. North Miami, FL 33161 – 10 Residential Units

UNDER CONSTRUCTION – 394-386 NE 174th St. North Miami, FL 33162 – 4 Residential Units

UNDER CONSTRUCTION – Florida City, FL 33034 – 7 Residential Units

UNDER CONSTRUCTION – 2788 NW 9th PL. Fort Lauderdale, FL 33311 – 1 Residential Unit

UNDER CONSTRUCTION – 138/152 NW 33 St. Miami, FL 33127 – 4 Residential Units

SOLD – 1324 NW 70th St. Miami, FL 33147 – 1 Residential Unit

SOLD – 3268 Southwest 23rd Terrace Miami, FL 33145 – 2 Residential Units

UNDER CONSTRUCTION – 1741 NW 76 St. Miami, FL 33147 – 1 Residential Unit